Table of Contents

In today’s competitive restaurant and retail environment, credit card processing fees can eat away at merchant profits and ISO residuals. Traditional pricing models have left merchants with limited choices: absorb the costs or pass them on in ways that sometimes cause customer friction.

That’s where Dual Pricing POS systems come in. By clearly presenting both a cash price and a card price at every point of sale, dual pricing creates transparency, compliance, and profitability. More ISOs are now adopting dual pricing POS as a way to eliminate processing fees for merchants, improve margins, and increase their own recurring revenue streams.

What is Dual Pricing?

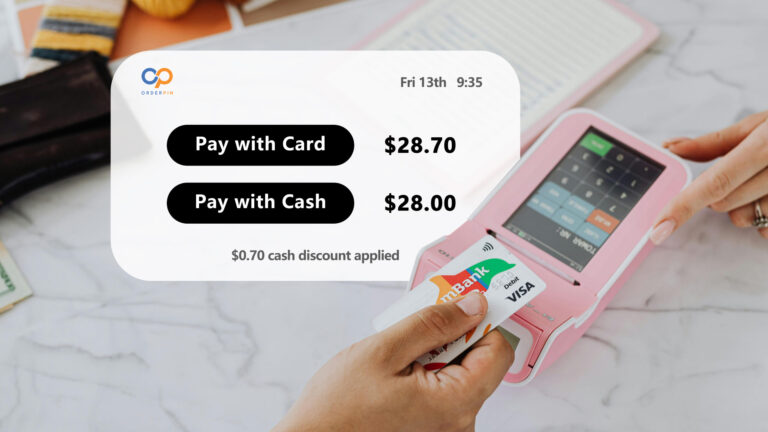

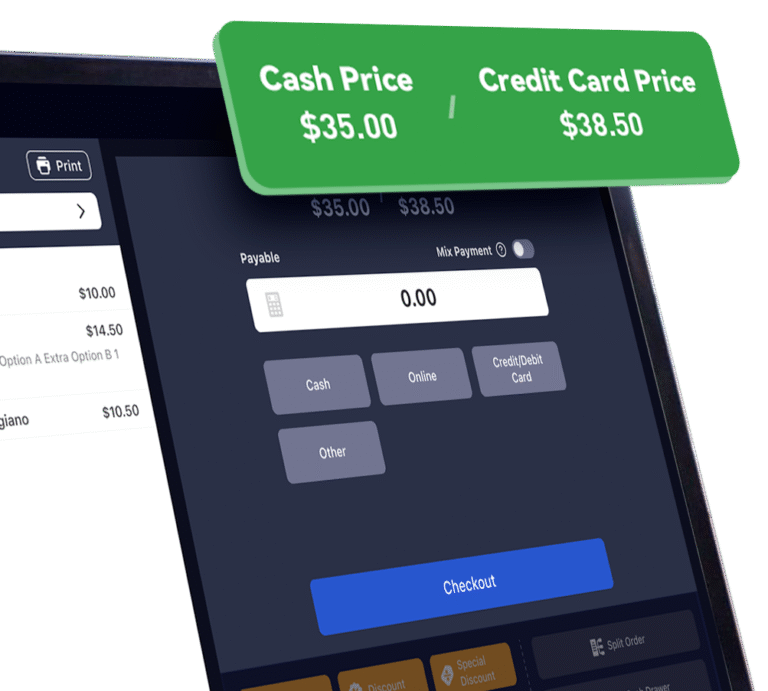

Dual Pricing means that a POS system displays two prices for every product or service:

- A cash price (often lower)

- A credit/debit card price (slightly higher, including processing costs)

Customers get the freedom to choose their preferred payment method. This model is already familiar in industries like gas stations, where cash and card prices have been displayed side by side for years.

How Dual Pricing Differs from Surcharge Programs

A surcharge program adds an extra fee to the final bill when a customer pays with a credit card. For example, a $100 ticket may have an added $3 surcharge for card use.

- Compliance risk: Surcharge rules vary by state and card brand (Visa, Mastercard, Amex, Discover). Some states restrict surcharging.

- Customer perception: Many customers dislike seeing a “penalty fee” added at checkout.

In contrast, dual pricing presents both prices upfront, avoiding surprises and aligning with consumer expectations.

How Dual Pricing Differs from Cash Discount Programs

A cash discount program advertises the higher card price as the “standard price,” then applies a discount at checkout if the customer pays with cash.

- Customer confusion: Some merchants worry that “discounts” can be misunderstood as temporary promotions rather than ongoing pricing.

- Receipt issues: If the POS system isn’t properly configured, receipts may confuse customers or violate card brand rules.

Dual pricing solves these challenges by displaying both prices clearly at all customer touchpoints — menus, online ordering, kiosks, printed receipts — ensuring full transparency and legal compliance.

What to Consider When Using a Restaurant POS System with Dual Pricing

Not all POS systems are built to handle dual pricing seamlessly. If you’re an ISO or merchant exploring this model, here are the key factors to evaluate:

1. Full Compliance with Card Brand and State Rules

- Ensure the POS provider updates software regularly to remain compliant with Visa, Mastercard, and state-level regulations.

- Dual pricing programs should automatically handle tax calculations, receipt formatting, and disclosures.

2. Transparent Customer Experience

- Prices should be displayed at every point of interaction: menu boards, printed menus, self-service kiosks, and online ordering platforms.

- Receipts should clearly show both options and the customer’s chosen method.

3. Seamless Integration with Restaurant Operations

- Dual pricing POS must support all restaurant workflows — dine-in, takeout, delivery, bar tabs, modifiers, tips — without slowing down operations.

- Integration with online ordering and delivery platforms is critical in today’s market.

4. Reporting and Accounting Clarity

- The POS should separate cash sales vs. card sales in reports for easier reconciliation.

- Accounting tools should make tax filing and profit analysis straightforward.

5. Merchant and Customer Education

- ISOs should provide training so merchants can confidently explain dual pricing to their customers.

- Simple in-store signage (“Pay by cash and save!”) helps ensure customer acceptance.

Benefits of Dual Pricing POS for ISOs and Merchants

Implementing dual pricing POS systems creates a win-win scenario: merchants save on fees, customers get transparency, and ISOs build stronger business models.

1. Elimination of Card Processing Fees for Merchants

One of the biggest pain points for restaurants is the 2–4% card processing fee that eats into profits. With dual pricing:

- Merchants effectively shift processing costs to card-paying customers.

- Cash-paying customers enjoy a lower price.

- Merchants no longer feel like they’re “losing money” on every card swipe.

This protects margins and frees up capital for reinvestment into staff, marketing, or new locations.

2. Increased Merchant Adoption and Retention

Many merchants hesitate to adopt surcharging programs because of customer backlash or compliance risks. Dual pricing POS addresses these concerns by:

- Offering a clear, upfront choice for customers.

- Keeping merchants compliant with card brand rules.

- Reducing disputes and chargebacks related to fees.

ISOs offering dual pricing POS gain a differentiator in a crowded payments market, making it easier to sign and retain merchants.

3. Higher ISO Profits and Recurring Revenue

Dual pricing POS doesn’t just benefit merchants — it also strengthens the ISO’s financial model.

- ISOs can offer dual pricing POS as a premium value-added service, generating SaaS subscription revenue in addition to payment residuals.

- Higher merchant satisfaction reduces churn, protecting long-term revenue streams.

• By positioning themselves as problem-solvers, not just resellers, ISOs gain stronger negotiating power and higher valuation multiples.

4. Improved Customer Trust and Transparency

Today’s consumers value honesty. By showing both prices upfront:

- Customers feel they’re making an informed choice.

- There’s less friction at checkout compared to surprise surcharges.

- Merchants build long-term trust with their customers, especially in community-driven businesses like restaurants.

5. Legal and Competitive Advantage

- Because dual pricing aligns with long-standing models like gas stations, it is more widely accepted by regulators and customers alike.

- Merchants using dual pricing gain a competitive edge by protecting margins without alienating card-paying customers.

- ISOs offering this model become early adopters in a fast-growing trend, positioning themselves as forward-thinking partners.

Joined OrderPin Sep. 2024

"So having Dual-Pricing POS, The law allows it, and customers are aware of it. I can say goodbye to fees eating up my profits! ---which is great for us!

Joseph Roces, Little Italy Restaurant, Daytona Beach, Florida

Conclusion: Why Dual Pricing POS is the Future

For years, ISOs and merchants have struggled with the burden of credit card processing fees. Surcharges and cash discount programs offered partial solutions, but each came with drawbacks.

Dual pricing POS systems provide the cleanest, most transparent, and most profitable path forward. They eliminate processing fees for merchants, boost ISO profits, and create a better customer experience.

For ISOs, the decision is strategic: adopt dual pricing POS now, and you’re not just selling another system — you’re delivering a future-proof business model that helps merchants thrive and positions your ISO for higher growth and valuation.