In today’s competitive retail and service landscapes, businesses need more than just basic payment processing—they require comprehensive systems that handle everything from transactions to inventory management. If you’re exploring “ISO total POS solution,” you’re likely seeking insights into how Independent Sales Organizations (ISOs) deliver end-to-end Point of Sale (POS) setups that streamline operations and boost efficiency. ISOs go beyond mere reselling; they provide integrated hardware, software, and services tailored to merchants’ needs, often at competitive prices.

This in-depth guide dives into how ISOs craft these complete solutions, with real-world examples, step-by-step integrations, and expert tips. Whether you’re a small business owner, reseller, or payment professional, you’ll learn how ISOs can transform your checkout process into a seamless, scalable operation.

What Are Complete POS Solutions from ISOs?

A complete POS solution from an ISO encompasses hardware, software, payment processing, and ongoing support, all bundled into a unified system. Unlike fragmented setups where merchants source components separately, ISOs offer “total solutions” that ensure compatibility and efficiency.

Key components include:

- Hardware: Terminals, scanners, and mobile devices for physical transactions.

- Software: Cloud-based platforms for inventory, reporting, and customer management.

- Processing: Secure gateways for card, contactless, and online payments.

- Support: Installation, training, and 24/7 maintenance.

These solutions are evolving with AI-driven analytics and omnichannel capabilities, helping businesses handle in-store, online, and mobile sales effortlessly. For high-risk or niche industries, ISOs customize features like fraud detection or industry-specific integrations.

Why ISOs Excel at Providing Total POS Solutions

ISOs partner with acquiring banks and tech providers, allowing them to offer flexible, white-label options without the rigidity of direct bank services. This intermediary role enables competitive pricing through residuals and commissions, making advanced POS accessible to SMBs. For instance, ISOs can bundle EMV-compliant terminals with CRM software, reducing setup costs by up to 30%.

Full-Stack Services Offered by ISOs

ISOs provide a “full-stack” approach, covering every layer of the POS ecosystem. Here’s a breakdown:

Hardware Provisioning

ISOs supply durable, versatile hardware tailored to business types:

- Terminals and Readers: NFC-enabled devices for contactless payments.

- Scanners and Peripherals: Barcode scanners and cash drawers for retail efficiency.

- Mobile POS: Tablet-based systems for pop-ups or field services.

Software and Customization

Custom software is a hallmark of ISO solutions:

- Inventory and Analytics: Real-time tracking and sales insights.

- Payment Gateways: Seamless integration with networks like Visa.

- Industry-Specific Features: For restaurants, add table management; for e-commerce, sync online orders.

Examples include Orderpin’s omnichannel tools, often resold by ISOs with white-label POS.

Transaction Processing and Security

ISOs handle the backend:

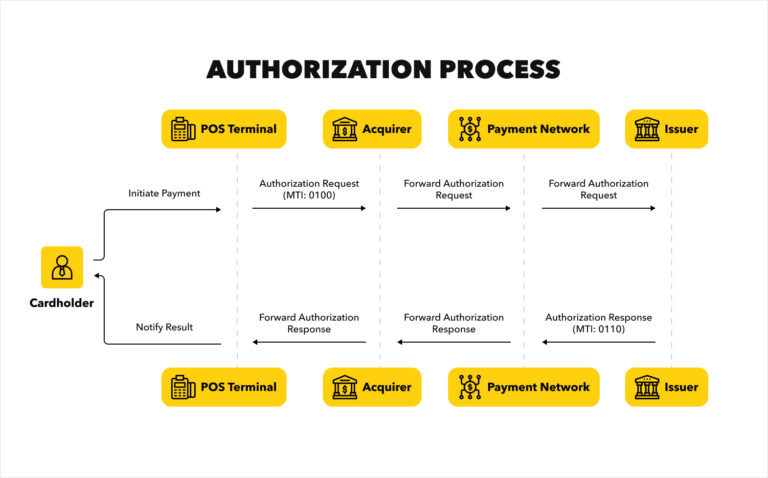

- Authorization and settlement.

- PCI DSS compliance.

- Fraud prevention via tokenization.

This ensures merchants process payments securely without managing complex infrastructure.

| Service Layer | ISO Offerings | Benefits |

|---|---|---|

| Hardware | Terminals, scanners, mobile devices | Durable, scalable for growth |

| Software | Cloud POS, analytics dashboards | Customizable, user-friendly |

| Processing | Gateways, settlement | Fast, secure transactions |

| Support | Training, maintenance | Minimizes downtime |

The Integration Process: How ISOs Make It Seamless

Integrating a complete POS solution involves a structured process:

- Assessment: ISO evaluates business needs, such as transaction volume or industry risks.

- Setup: Deploy hardware and configure software, often with API integrations for existing systems.

- Testing: Simulate transactions to ensure compatibility.

- Launch and Training: Go-live with staff onboarding.

- Ongoing Optimization: Updates and analytics monitoring.

For example, an ISO might integrate a POS with ERP software, enabling automatic inventory updates post-sale.

Benefits of Choosing an ISO for Your POS Solution

- Cost Savings: Bundled pricing lowers overall expenses.

- Scalability: Easy upgrades as businesses grow.

- Customization: Tailored to industries like retail or hospitality.

- Enhanced Security: Built-in compliance reduces risks.

- Better Support: Dedicated teams vs. bank call centers.

With the POS market exceeding $100 billion, ISOs are key for adopting trends like AI fraud detection and contactless payments.

Trends in ISO-Provided POS Solutions

- AI Integration: Predictive analytics for stock and customer behavior.

- Omnichannel: Unified in-store and online experiences.

- Sustainability: Eco-friendly hardware and digital receipts.

- Mobile-First: Rise of mPOS for flexible operations.

FAQs About ISO POS Solutions

What makes an ISO POS solution "complete"?

It includes hardware, software, processing, and support in one package.

How do ISOs differ from direct processors?

ISOs offer more flexibility and customization at lower costs.

Can ISOs handle international payments?

Yes, many support multi-currency and global networks.

What industries benefit most?

Retail, restaurants, e-commerce, and high-risk sectors.

How to get started with an ISO?

Contact a registered ISO for a needs assessment.

ISOs provide complete POS solutions by integrating hardware, software, and services into efficient, tailored systems that drive business success. It’s clear why they’re the go-to for modern merchants. Explore options from reputable ISOs to elevate your operations.

An ISO POS system is a powerful, flexible way to streamline payments. From definitions to trends, this guide equips you to choose wisely. Ready to implement? Contact us for tailored advice on boosting your ISO’s success>>