In the fast-evolving world of payment processing, businesses are increasingly turning to flexible, efficient solutions to handle transactions. If you’re searching for “ISO POS system,” you’re likely a merchant, reseller, or payment professional looking to understand how Independent Sales Organizations (ISOs) integrate with Point of Sale (POS) systems. This ultimate guide for 2025 breaks it all down, from definitions to trends, helping you make informed decisions for your business.

An ISO POS system combines the services of an Independent Sales Organization—a third-party entity authorized to resell payment processing and merchant services—with POS hardware and software for seamless transactions. Unlike direct bank setups, ISOs offer customized, scalable solutions often at lower costs, making them ideal for small to medium-sized businesses (SMBs).

Whether you’re a retailer upgrading your checkout or an agent exploring resale opportunities, this 3,000+ word guide covers everything. We’ll explore how ISOs work, real-world examples, comparisons, and emerging 2025 trends like AI integration and contactless payments.

What Is an ISO in Payment Processing?

To grasp an ISO POS system, start with the basics of an ISO. An Independent Sales Organization (ISO) is a third-party company that partners with acquiring banks and payment processors to sell merchant services, including credit card processing, POS systems, and related tools. ISOs aren’t banks themselves but act as intermediaries, handling everything from merchant onboarding to ongoing support.

Key roles of an ISO include:

- Merchant Account Setup: ISOs underwrite and approve accounts, often faster than traditional banks.

- Payment Gateway Integration: They connect POS systems to networks like Visa and Mastercard.

- Risk Management: Ensuring compliance with PCI DSS standards to prevent fraud.

- Customer Support: Providing 24/7 assistance for hardware issues or transaction disputes.

In 2025, ISOs are projected to handle a larger share of the $90 billion POS market, driven by mobile and cloud-based systems. For high-risk merchants (e.g., e-commerce or CBD sellers), ISOs offer specialized solutions that banks might avoid.

ISOs provide flexibility and cost savings. For instance, they earn commissions through residuals on transactions, allowing them to offer competitive pricing without the overhead of banks. This model benefits SMBs by bundling POS hardware, software, and processing into one package.

How Do ISOs Work with POS Systems?

ISOs don’t just sell payment processing—they integrate it deeply with POS systems to create a “total solution.” Here’s the step-by-step process:

- Partnership with Acquirers: ISOs register with sponsoring banks (acquirers) to gain access to payment networks. This allows them to resell services legally.

- Merchant Onboarding: An ISO assesses a business’s needs, sets up a merchant account, and deploys POS hardware/software.

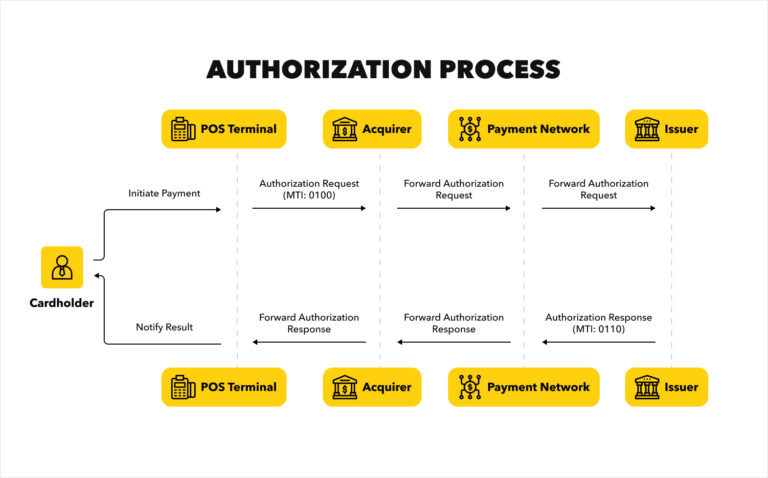

- Transaction Flow: When a customer pays, the POS system captures data, sends it via the ISO’s gateway to the acquirer, then to card networks for approval.

- Settlement and Reporting: Funds are deposited into the merchant’s account, with the ISO handling residuals and providing analytics.

- Ongoing Management: ISOs offer maintenance, updates, and expansions like adding mobile POS for pop-up shops.

For example, an ISO might partner with a tech provider like Orderpin to deliver Android-based SmartPOS terminals, combining payments with inventory management. This “white-label” approach lets ISOs brand solutions as their own.

In practice, ISOs handle both card-present (in-store) and card-not-present (online) transactions, making them versatile for omnichannel retail.

Case Study: A Retail Chain's ISO POS Transformation

Consider a mid-sized restaurant chain that switched to an ISO-provided POS system. Previously using outdated bank hardware, they faced slow transactions and high fees. Partnering with an ISO, they integrated cloud-based POS with AI analytics, reducing onboarding time by 50% and boosting efficiency. Result: 20% faster checkouts and real-time inventory tracking, leading to $50,000 in annual savings.

Another example from OrderPin: A small boutique leveraged their ISO-resold POS to handle contactless payments and loyalty programs, increasing repeat business by 15%.

POS Hardware and Software Examples for ISOs

ISO POS systems include a mix of hardware for physical interactions and software for data management. Here’s a breakdown:

Common POS Hardware

- Terminals and Registers: Touchscreen devices for ringing up sales.

- Card Readers: EMV-chip and NFC-enabled readers for contactless payments.

- Barcode Scanners: Handheld or fixed scanners from brands to speed inventory.

- Cash Drawers and Printers: Secure drawers and thermal printers for receipts.

- Mobile POS: Tablets or smartphones for on-the-go sales.

ISO vs. Bank for POS Systems: A Full Comparison

Choosing between an ISO and a bank for your POS system? ISOs often win for flexibility, while banks provide stability. Here’s a detailed breakdown:

- Setup Speed: ISOs approve accounts in days; banks take weeks due to stricter underwriting.

- Cost: ISOs offer lower fees (e.g., 2.6% + $0.10 per transaction) via residuals; banks charge higher fixed rates.

- Customization: ISOs provide tailored POS bundles; banks stick to standard offerings.

- Support: ISOs excel in personalized service; banks may route you through general channels.

- Risk Tolerance: ISOs handle high-risk merchants; banks often decline them.

| Aspect | ISO | Bank |

|---|---|---|

| Flexibility | High (custom integrations) | Low (standard products) |

| Cost-Effectiveness | Competitive residuals | Higher fees |

| Approval Time | 1–3 days | 1–4 weeks |

| Scalability | Excellent for growth | Limited |

| Support Quality | Dedicated, 24/7 | General banking support |

For most SMBs in 2025, ISOs are the better choice, especially with trends like QR codes and NFC demanding agile systems.

2025 Trends in ISO POS Systems

Looking ahead, ISO POS systems are evolving rapidly:

- AI and Automation: Predictive analytics for inventory and fraud detection.

- Contactless and Mobile: NFC, QR codes, and mobile wallets dominate, with ISOs integrating them seamlessly.

- Omnichannel Integration: Unified online/in-store experiences, projected to boost sales by 25%.

- Sustainability: Eco-friendly hardware and paperless receipts.

- Security Enhancements: Biometrics and tokenization to combat rising cyber threats.

Expect the POS market to hit $90 billion, with ISOs leading in cloud and FinTech adoptions.

FAQs About ISO POS Systems

What is the difference between an ISO and an ISV?

An ISO focuses on sales and merchant services, while an ISV develops software. They often collaborate for complete POS solutions.

How much does an ISO POS system cost?

Hardware starts at $200–$1,000; software $0–$300/month. Processing fees average 2–3% per transaction.

Can ISOs handle high-risk businesses?

Yes, they specialize in niches banks avoid, with tailored risk management.

How do I become an ISO agent for POS systems?

Register with a sponsoring bank, get certified, and build a resale network.

What are the benefits for resellers?

Residual commissions create passive income, with top programs offering 50–80% splits.

For more on choosing the right system, check our internal link: best ISO POS systems for SMBs.

An ISO POS system is a powerful, flexible way to streamline payments in 2025. From definitions to trends, this guide equips you to choose wisely. Ready to implement? Contact us for tailored advice on boosting your ISO’s success>>